Managing institutional funds or client wealth? Looking to enhance your risk-adjusted returns AND differentiate your client offerings to attract and retain assets?

Let’s talk.

Think of us as your Financial Architect

Just like designing your dream house:

🏠 House Architect: “How many rooms? Where’s the kitchen? What’s your budget?”

📊 Financial Architect: “What’s your investment objective? Which universe? What exposure level?”

Here’s How It Works:

You Tell Us:

- Investment objective (growth, income, hedging?)

- Investment universe (equities, bonds, crypto, commodities?)

- Desired exposure level (conservative, moderate, aggressive?)

- Time horizon (1 year, 5 years, perpetual?)

- Constraints (regulatory, risk limits, ESG requirements?)

We Design:

- Custom financial structure tailored to your specifications

- Optimal risk management framework

- Capital protection mechanisms (if required)

- Competitive differentiation for your client offerings

We Source:

- Proposals from A-rated issuers

- Regulatory specialist coordination

- Best execution venues

The Result?

A bespoke financial instrument built specifically for your institution’s needs – and your clients’ success.

Not off-the-shelf. Not one-size-fits-all. Architected for you.

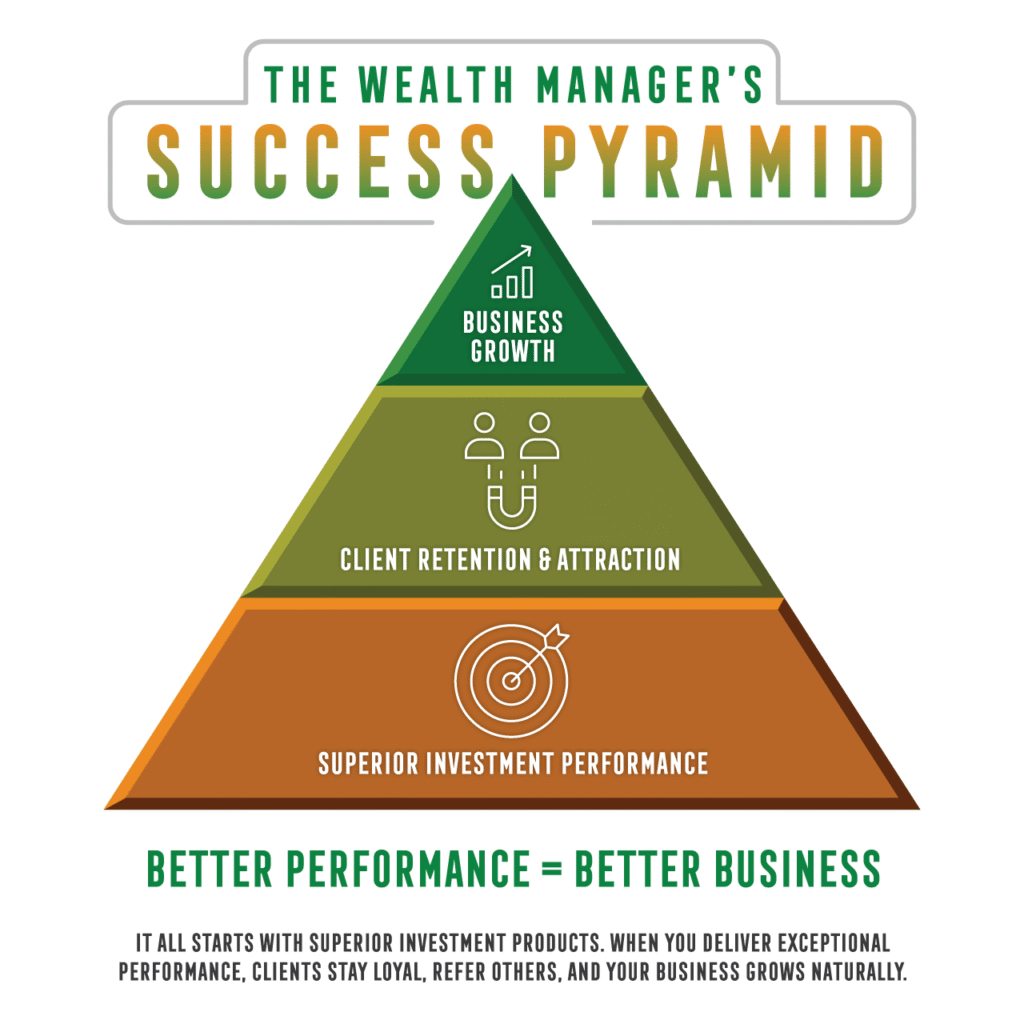

Better products = Better client outcomes = Business growth

Ready for a free consultation?

- Americas: charles.v@azzilon.com

- ASEA-MENA-Europe: charles.v@invess.ai